BSU Token: What It Is and Why It Matters

When exploring BSU token, a community‑driven cryptocurrency built on a public blockchain. Also known as BSU, it aims to combine utility, governance, and reward mechanisms.

Another key player in this space is DeFi, a set of decentralized financial services that let users lend, borrow, and earn without banks. DeFi platforms often host airdrop, free token distributions used to bootstrap network adoption campaigns that directly involve tokens like BSU. Finally, tokenomics, the economic design of a token, including supply, emission schedule, and utility defines how BSU interacts with users and markets.

How BSU Token Fits Into the Blockchain Ecosystem

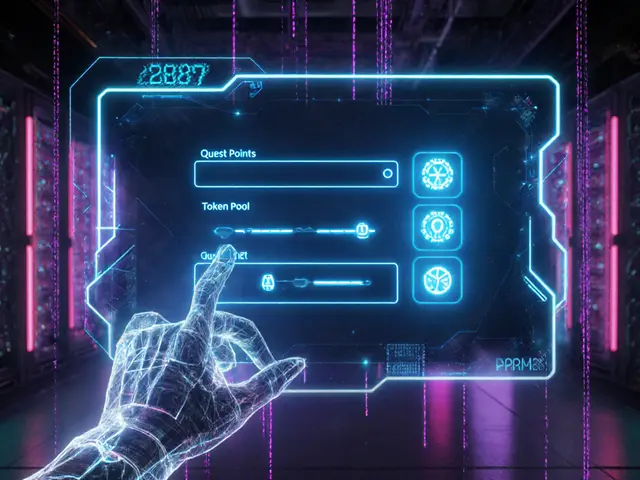

BSU token runs on a scalable layer‑1 blockchain that supports smart contracts and low‑fee transactions. This architecture enables developers to build dApps that reward participants with BSU, while the blockchain’s consensus mechanism ensures security and transparency. The token’s smart‑contract logic governs minting, burning, and staking, which in turn shapes its circulating supply.

Tokenomics influences BSU’s market behavior: a capped supply creates scarcity, while periodic staking rewards encourage holders to lock up tokens, reducing sell pressure. These dynamics affect price stability and community growth, making BSU attractive for both investors and protocol builders.

DeFi integration is another core pillar. BSU can be used as collateral on lending platforms, as liquidity in automated market makers, or as a governance token that lets holders vote on protocol upgrades. By linking tokenomics with DeFi utility, BSU creates a feedback loop where increased usage drives demand, which then reinforces its economic model.

Airdrops play a strategic role in expanding BSU’s user base. Early‑stage projects often distribute tokens to wallet addresses that meet simple criteria—like holding a partner token or completing a social task. This boosts awareness, seeds liquidity, and can jump‑start network effects without costly marketing campaigns.

Security considerations can’t be ignored. Because BSU operates on an open blockchain, anyone can audit its contracts, but users still need to protect private keys and verify official distribution channels. Trusted wallets and hardware devices reduce the risk of losing BSU to phishing or malware.

Community governance rounds out the picture. Holders vote on proposals ranging from fee adjustments to new feature rollouts. This democratic process empowers the token community, aligning incentives between developers and users and fostering long‑term sustainability.

Below you’ll find a curated collection of articles that dive deeper into each of these aspects—how BSU tokenomics shape price, step‑by‑step airdrop guides, real‑world DeFi use cases, and security best practices. Explore the list to get actionable insights and stay ahead of the curve in the BSU token space.