Ethereum: The Backbone of DeFi, Smart Contracts, and Web3

When you use a decentralized app, trade a token, or stake crypto, you’re probably interacting with Ethereum, a programmable blockchain that runs code without intermediaries. Also known as ETH, it’s not just a cryptocurrency—it’s the operating system for the open internet. Unlike Bitcoin, which mostly moves value, Ethereum runs programs—called smart contracts—that automate everything from lending to gaming to voting. That’s why over 70% of all DeFi apps, NFT marketplaces, and DAOs run on it.

But Ethereum isn’t one thing. It’s a stack. At its core is the execution layer, where smart contracts run and users interact with apps. Above it sits the settlement layer, the secure foundation that confirms transactions and prevents fraud. And because the main chain can’t handle millions of users, Ethereum L2s, like Arbitrum and Optimism, handle fast, cheap transactions off-chain while still being secured by Ethereum. These aren’t side projects—they’re the reason Ethereum still dominates after a decade.

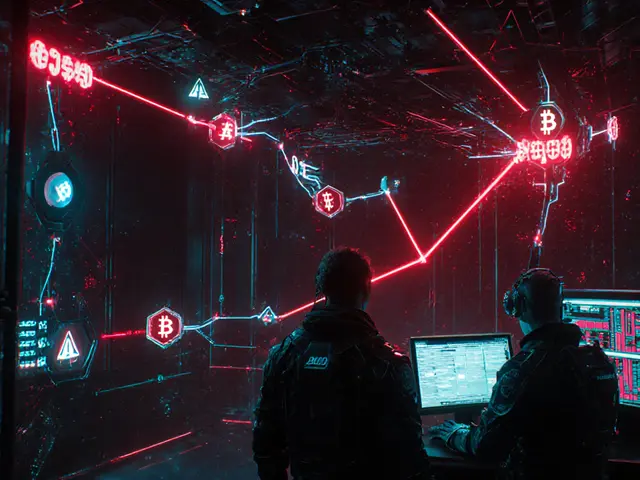

People think Ethereum is just about trading ETH. But look closer: it’s the reason creators get paid directly by fans, why crypto exchanges need licenses in Germany, and how 51% attacks target smaller chains because they lack Ethereum’s security. It’s the reason you need to audit smart contracts before trusting a DeFi protocol. And it’s why fake airdrops for tokens like ARV or CHMB keep popping up—because they’re trying to ride Ethereum’s reputation.

What you’ll find below isn’t a list of random articles. It’s a map of Ethereum’s real-world impact: how it enables modular blockchains, how regulators are trying to control it, and how scams exploit its name. Whether you’re trying to understand why your wallet connects to Ethereum, or why a token called AVXT says it’s on Avalanche but still acts like an Ethereum project, this collection cuts through the noise. No fluff. Just what Ethereum actually does—and what happens when it’s misunderstood.