MiCAR Germany: What It Is, How It Affects Crypto, and What You Need to Know

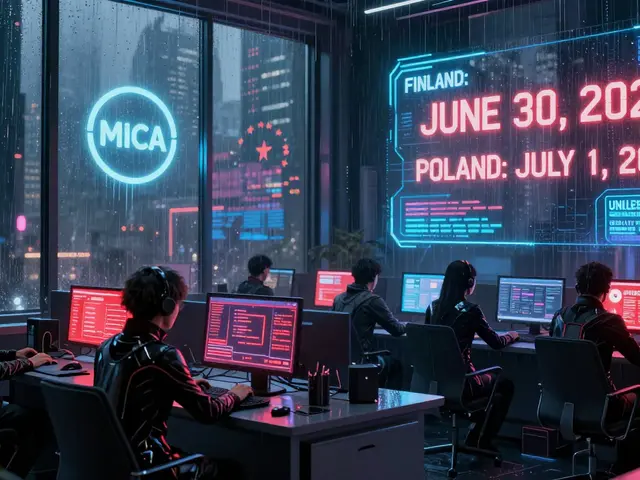

When you hear MiCAR Germany, the German implementation of the EU’s Markets in Crypto-Assets Regulation. Also known as MiCA, it’s not just another rulebook—it’s the first time the whole EU has agreed on how to treat crypto like real financial assets. Before MiCAR, crypto businesses in Germany operated in a gray zone. Now, if you’re running a crypto exchange, issuing a token, or even just holding certain digital assets, you’re under new rules that match traditional finance—without the old-school bureaucracy.

MiCAR Germany doesn’t exist alone. It’s part of a larger system called MiCA, the EU-wide regulation that standardizes crypto rules across all 27 member states. This means a crypto firm in Berlin has to follow the same basic rules as one in Lisbon or Warsaw. The big changes? Exchanges must now get licensed, stablecoins need reserve transparency, and token issuers can’t just make up claims about their project. If you’ve seen posts here about BityPreço or IslandSwap being sketchy, MiCAR is why those kinds of platforms are getting squeezed out. Authorities now have clear power to shut down unlicensed operators.

For everyday users, MiCAR Germany means more protection—but also more paperwork. If you’re using a German crypto exchange, you’ll likely see stricter KYC checks. If you’re into DeFi, you’ll notice fewer shady tokens listed on platforms that want to stay legal. The regulation doesn’t ban anything outright, but it forces projects to prove they’re real. That’s why posts about EzyStayz, Apple Network, or 1MIL airdrops show up here—they’re the kind of projects MiCAR was built to kill.

And it’s not just about scams. Crypto compliance, the process of following legal rules for digital assets. is now a core part of doing business in Europe. Firms that used to ignore AML rules or skip audits now face fines or shutdowns. This is why you’re seeing more reviews here about regulated platforms like Mercado Bitcoin and BC Bitcoin—they’re the ones adapting, not the ones pretending.

What’s missing from MiCAR? It doesn’t cover every crypto use case yet. NFTs, decentralized governance, and some DeFi protocols still have blurry edges. But for exchanges, stablecoins, and utility tokens? The rules are clear. And Germany? It’s one of the strictest enforcers.

Below, you’ll find posts that dig into how these rules play out in real life—from how Bangladeshis bypass crypto blocks to how blockchain forensics helps regulators track bad actors. MiCAR Germany didn’t create these problems, but it’s changing how they’re solved. Whether you’re trading, investing, or just trying to stay safe, this is the new landscape. Know it. Understand it. Navigate it.