Imagine buying a house in 72 hours-no lawyers, no inspections, no waiting for bank approvals. Just a digital deed on the blockchain and a signature in your wallet. Sounds like the future? It’s already happening in places like Wyoming and Georgia. But for every success story, there are ten more that collapsed because of something no one talks about: regulation.

Real Estate NFTs Aren’t Just Digital Deeds

Real estate NFTs aren’t fancy JPEGs of houses. They’re blockchain-based representations of actual property ownership-either full or fractional. When you buy a real estate NFT, you’re not buying a picture. You’re buying legal rights to a piece of land or a building, recorded on Ethereum, Polygon, or Solana. Smart contracts handle rent collection, maintenance fees, and even resale terms automatically. This cuts out middlemen, slashes transaction costs by 30-50%, and turns a 60-day closing into a 2-day transfer.But here’s the catch: the law hasn’t caught up. In most countries, no one has clearly said whether a real estate NFT is a security, a commodity, a utility token, or something entirely new. And that ambiguity is killing adoption.

The Regulatory Wild West

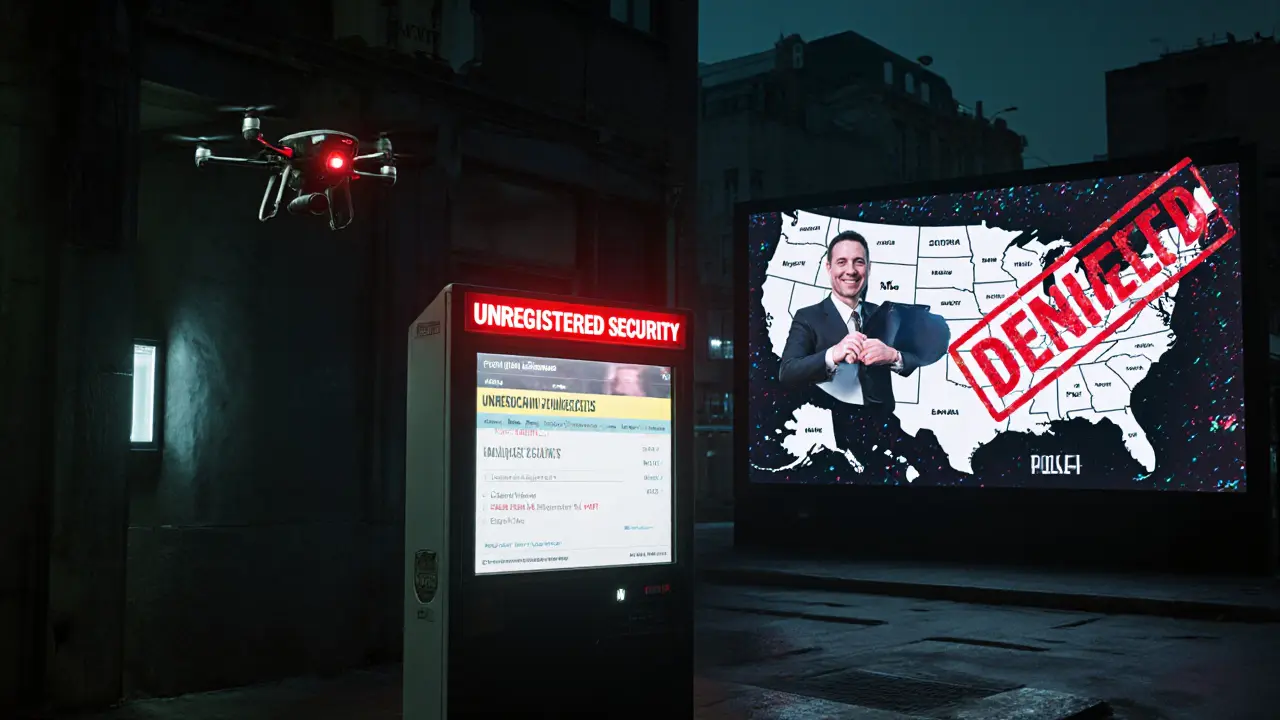

Different countries treat real estate NFTs in wildly different ways. In Switzerland, tokenized properties are treated like traditional assets with clear tax and ownership rules. Singapore has a sandbox for blockchain real estate experiments. Georgia has been running a blockchain land registry since 2016-over 1.2 million transactions, zero fraud.In the U.S., it’s chaos. The SEC has taken action against platforms like TokenHomes, calling their NFTs unregistered securities. That’s not a warning. That’s a shutdown. Investors lost $8.7 million overnight. Meanwhile, in states like Wyoming, blockchain titles are legally recognized. So you can buy a property in Wyoming using an NFT, but if you try to transfer it to California? Good luck. No state recognizes Wyoming’s blockchain deed.

The European Union’s MiCA regulation, which went live in December 2024, was supposed to bring order. But it doesn’t mention real estate NFTs at all. So now, 45% of NFT projects don’t know if they’re legal. Germany treats them like financial instruments. France treats them like digital goods. Italy? Still figuring it out. This patchwork makes cross-border deals nearly impossible.

Why This Matters More Than You Think

This isn’t just about crypto investors losing money. It’s about real people-retirees, small investors, immigrants-who want to buy into real estate but can’t afford a million-dollar home. Fractional ownership via NFTs lets you buy 5% of a Toronto condo for $50,000. That’s life-changing.But without clear rules, banks won’t lend against NFT-backed property. Insurance companies won’t cover it. Title insurers won’t issue policies. And without those, the whole system collapses. You can’t sell what no one trusts.

Take Reddit user u/BlockchainNewbie2025, who bought a fractional stake in a Miami apartment. Six months later, they tried to sell. No buyers. Why? Bid-ask spreads were 22%. No liquidity. No clear ownership records. No way to prove the NFT was legally tied to the deed. They lost $15,000 in value.

Technical Hurdles Are the Easy Part

People talk about gas fees, wallet security, and network congestion. Yes, Ethereum transactions cost $5-$12 and take 15 minutes. Polygon is cheaper and faster. But those are solvable problems. You can build bridges between chains. You can use multi-signature wallets. You can even get insurance from Nexus Mutual.The real problem isn’t tech. It’s law. Title registries in 90% of countries still run on paper or outdated digital systems. They don’t talk to blockchains. There’s no standard way to link a blockchain NFT to a county’s official land record. That means even if you own the NFT, the government doesn’t recognize you as the legal owner. That’s not a bug. It’s a dealbreaker.

And then there’s KYC. To buy a real estate NFT, you need to verify your identity-same as buying a house. But blockchain platforms often require you to submit documents to a third-party provider, wait 2-3 days, and then still get rejected because the jurisdiction doesn’t accept your ID type. One investor from Brazil spent three weeks trying to complete a purchase in Canada. He gave up. The platform didn’t support his passport.

Who’s Winning? Who’s Losing?

The winners are jurisdictions that moved fast. Sweden’s Lantmäteriet blockchain registry has a 4.7/5 clarity rating. Georgia’s system processes 10,000 transactions a month with zero fraud. Switzerland’s legal clarity has made it a hub for institutional tokenized real estate-19% of commercial deals now use blockchain.The losers? Small platforms. Startups like TitleToken and BlockTitle raised $185 million in early 2025, but 30% of them have delayed launches because they can’t figure out compliance. The cost of legal counsel for a single NFT real estate project now averages $120,000. That’s not sustainable for indie developers.

Big players like JPMorgan and Propy are playing the long game. JPMorgan’s Onyx blockchain handles commercial real estate deals behind closed doors, mostly for clients who already have legal teams. Propy has completed 1,200 cross-border transactions-but only in countries with clear rules. They avoid the U.S. entirely except for Wyoming.

What’s Next? The Regulatory Turning Point

The SEC is expected to release a framework for real estate token classification by Q4 2025. That could be the spark. If they classify real estate NFTs as securities, platforms will have to register, disclose, and follow strict rules. That’s bad news for startups-but good news for investors. Clarity means safety.The EU is testing a pilot program across 12 Eurozone countries to create a unified cross-border real estate NFT system. If it works, it could become the model for the rest of the world.

But here’s the hard truth: regulation won’t come from tech companies. It won’t come from blockchain developers. It will come from governments that finally realize they can’t ignore this. Real estate is the largest asset class on Earth-$327 trillion. Tokenization could unlock trillions in liquidity. But only if the rules are clear.

Can You Invest in Real Estate NFTs Today?

Yes-but only if you’re careful.- Stick to platforms that operate in jurisdictions with clear rules: Switzerland, Singapore, Georgia, Wyoming.

- Avoid platforms that don’t disclose their legal basis or don’t partner with licensed title insurers.

- Never invest more than you can afford to lose. Liquidity is low. Selling is hard.

- Use multi-signature wallets. Keep your private keys offline. 23% of losses come from lost or stolen keys.

- Check if the NFT is tied to a real-world deed. If not, it’s just a speculative token.

Real estate NFTs have the potential to make property ownership more open, fair, and efficient. But right now, they’re a legal minefield. The technology is ready. The market is ready. The regulators? Not yet.

If you’re waiting for the dust to settle, you’re not late. You’re smart.

Are real estate NFTs legal?

It depends on where you are. In Georgia, Sweden, Switzerland, Singapore, and parts of the U.S. like Wyoming, real estate NFTs are legally recognized. In most other places, including most of the U.S., Canada, and the EU, their legal status is unclear. Some governments treat them as securities, others as digital goods. Until a country passes specific laws, ownership rights are uncertain.

Can I get a mortgage on a real estate NFT?

Almost never. No major bank or lender currently accepts real estate NFTs as collateral. Why? Because they don’t recognize the NFT as legal proof of ownership. Even if the blockchain shows you own the property, the county land registry doesn’t. Until governments and banks align on this, mortgages won’t be available.

What happens if the blockchain goes down?

Blockchains don’t "go down" like websites. Ethereum and Polygon are decentralized networks with thousands of nodes running globally. Even if one node fails, the network keeps working. But if the smart contract has a bug or the platform hosting your NFT shuts down, you could lose access to metadata (like photos or deeds). That’s why it’s critical to verify that the NFT is linked to an official, government-recognized property record-not just a website.

Are real estate NFTs a good investment?

They can be-but only if you treat them like high-risk, illiquid assets. Unlike stocks or REITs, you can’t easily sell them. Bid-ask spreads are often 15-20%. There’s no public market. Most buyers are crypto-native investors, not traditional real estate buyers. Only invest if you understand the legal risks and are prepared to hold for years.

Can I buy a real estate NFT from another country?

Technically yes, but legally risky. A U.S. investor bought a property in Spain using an NFT in 2024-then couldn’t rent it out because Spanish law didn’t recognize the NFT as a lease agreement. The tenant refused to pay. The investor lost $120,000. Cross-border NFT real estate deals require legal alignment between both countries. Most don’t have it.

What’s the biggest risk with real estate NFTs?

The biggest risk isn’t hacking or scams-it’s legal uncertainty. You could own the NFT, but if the government doesn’t recognize it as proof of ownership, you have no rights. No eviction power. No resale guarantee. No inheritance path. That’s why 68% of negative reviews on Trustpilot cite regulatory confusion as the main reason they lost money.

Comments

17 Comments

Kaitlyn Boone

real estate nfts are just a scam waiting to happen. no one in their right mind would trust a digital token over a paper deed. i saw someone lose 15k on a miami condo nft and the whole thing was a ghost town. no buyers, no legal backup, just a bunch of crypto bros pretending they own something.

Dexter Guarujá

you people are clueless. america built the free market, not some eu bureaucrat with a powerpoint. wyoming got it right-blockchain titles are legal there, and that’s all that matters. if you can’t handle innovation, stay in california where they still file deeds by hand. this isn’t about regulation-it’s about control. the feds want to keep you dependent on their outdated systems.

Jennifer Corley

you’re ignoring the data. 68% of losses come from regulatory confusion, not tech failure. the fact that you think wyoming’s model is scalable is naive. what happens when the next state sues a platform for fraud? there’s no federal framework. no precedent. no safety net. you’re not a pioneer-you’re a liability.

Natalie Reichstein

if you think this is about freedom, you’re delusional. this is about bypassing centuries of legal infrastructure built to protect people. you don’t get to replace title insurance with a smart contract and call it progress. what happens when grandma dies and her nft deed isn’t recognized by the probate court? who inherits it? the blockchain? please. this isn’t innovation-it’s legal vandalism.

James Edwin

the tech is ready. the demand is real. people want to invest in real estate without needing a million bucks. fractional ownership could change lives. yes, the rules are messy-but that’s why we need to push for clarity, not retreat. look at georgia. 1.2 million transactions, zero fraud. that’s not luck. that’s vision. we need more of that, not fear.

Kris Young

the biggest issue isn’t regulation-it’s trust. if the government doesn’t recognize the nft as proof of ownership, then the nft is just a digital receipt. no bank, no insurer, no lawyer will take it seriously. until that changes, it’s not real estate-it’s a crypto experiment with a house in the background.

LaTanya Orr

what does ownership even mean anymore? if the deed is on a blockchain but the county doesn’t know about it, are you really the owner? or are you just the person who holds the key to a digital file that no one else acknowledges? maybe the real question isn’t how to regulate it-but whether we still believe in physical institutions at all

taliyah trice

my cousin in nigeria tried to buy a property in texas using an nft. got rejected because her nigerian passport wasn’t accepted. she spent 3 weeks trying to verify her identity. no one told her the system didn’t recognize her docs. that’s not innovation. that’s exclusion dressed up as tech.

Terry Watson

think about this: if a blockchain goes down-wait, no, it doesn’t-but if the platform hosting your nft metadata shuts down, you lose the photos, the survey maps, the deed copy. the blockchain keeps the token, but the meaning? gone. so you own a token that points to nothing. that’s not ownership. that’s a digital ghost.

Mike Stadelmayer

i’m not against it. i just think we’re moving too fast. the tech is cool, sure. but real estate is emotional. people buy homes for their kids, for stability, for legacy. you can’t turn that into a trading pair. let’s build the legal rails first. then we can ride the train.

Norm Waldon

the eu is running a pilot? of course they are. they’re trying to control everything. they want to make every transaction traceable, every owner monitored. this isn’t about efficiency-it’s about surveillance. and wyoming? they’re the last free state. don’t let them take that away. if you support this, you’re supporting global digital serfdom.

neil stevenson

bro just use a multi-sig wallet and stick to georgia or switzerland. i bought a piece of a berlin flat last year. 2 days, no lawyer, no stress. the deed is on chain, the local registry has a link. it’s not perfect-but it works. stop overthinking. just do it smart.

Samantha bambi

real estate nfts are the future, and anyone who says otherwise is clinging to paper because they’re afraid of change. i’ve seen low-income families buy 5% of a condo in toronto and start earning rent. that’s justice. regulation will catch up. it always does. we just have to keep pushing.

Anthony Demarco

you think this is about property? no. this is about power. the old guard-lawyers, banks, title companies-they’ve been raking in fees for centuries. now a kid in a hoodie can bypass them with a wallet. that’s why they’re scared. they don’t care about safety. they care about control. and they’ll use regulation as a weapon to crush competition

Lynn S

Let me be perfectly clear: without legal recognition, an NFT is nothing more than a speculative token masquerading as an asset. You cannot transfer rights that do not exist in the eyes of the law. The notion that blockchain can override centuries of property jurisprudence is not only arrogant-it is dangerously irresponsible.

Jack Richter

yeah ok

sky 168

start small. stick to places with clear rules. use multi-sig. never invest more than you can lose. and always check if the nft links to a real deed. that’s it.

Write a comment