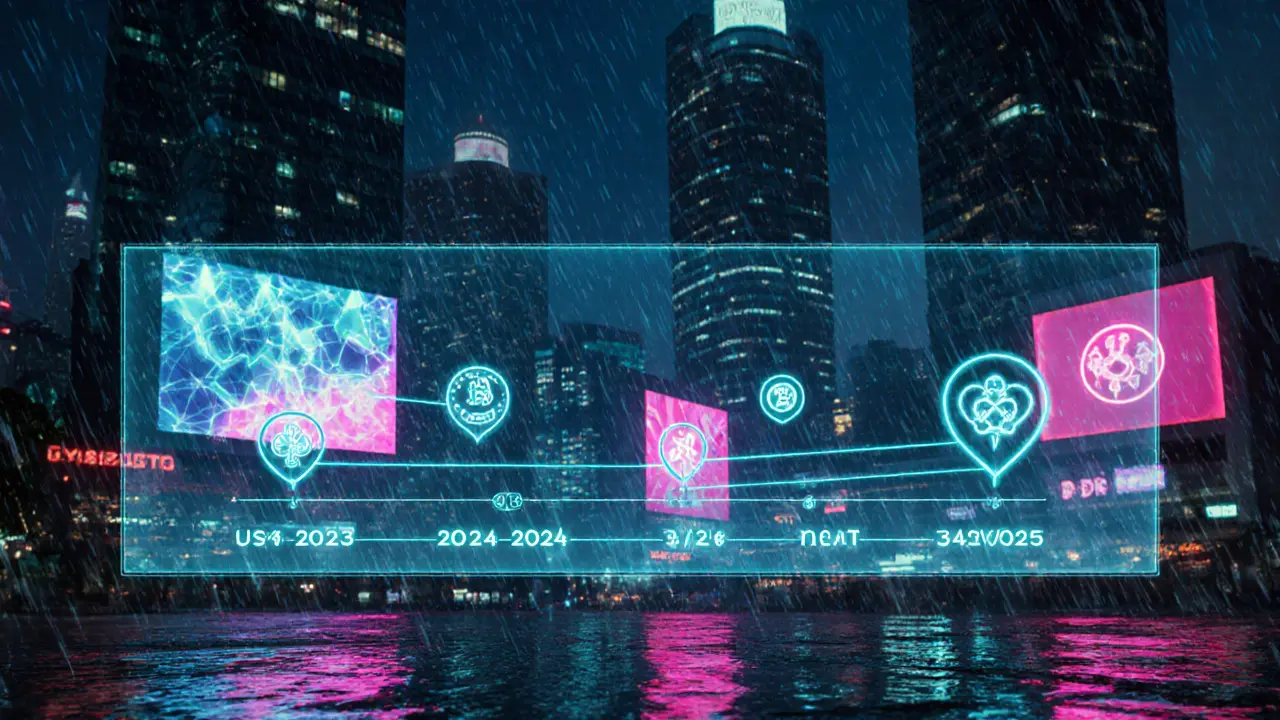

Indonesia Crypto Regulations Timeline

This interactive timeline shows the key regulatory shifts affecting Indonesia's cryptocurrency landscape from 2023 to 2025. Understand how the classification of crypto changed from commodity to digital financial asset and the major compliance requirements introduced.

Jan 12, 2023

Law No. 4 of 2023 (Development and Strengthening of the Financial Sector Law) passed, giving OJK authority over digital financial assets.

Legal ChangeJan 10, 2025

OJK becomes the sole supervisory authority for crypto trading, staking, and custody services, effective date for regulatory transition.

Regulatory FrameworkDec 10, 2024

Regulation No. 27/2024 details implementation of digital financial asset trading, including licensing, capital standards, and AML requirements.

Regulatory FrameworkAug 1, 2025

PMK 50/2025 removes VAT from crypto transfers and aligns taxation with ordinary income rules.

Tax ReformApr 2025

Exchanges must publish a refreshed whitelist of approved tokens or face delisting.

Compliance RequirementCurrent Regulatory Status

Classification: Digital Financial Asset

Supervisory Authority: OJK

Trading Status: Legal to trade but illegal as payment method

Minimum Capital: IDR 100 billion paid-up capital, IDR 50 billion equity

VAT Status: Removed effective Aug 1, 2025

Indonesia’s crypto landscape shifted dramatically in early 2025. After years of treating digital coins as commodities under the Commodity Futures Trading Regulatory Agency, the country moved the whole framework under the Financial Services Authority, re‑branding crypto as a “digital financial asset.” If you’re wondering how the change affects traders, exchanges, and tax obligations, this guide walks you through every moving part.

Quick Takeaways

- Effective 10Jan2025, oversight moved from BAPPEBTI to OJK.

- Crypto remains legal to trade but illegal as a payment method.

- New capital minimum: IDR100bn paid‑up, IDR50bn equity for traders.

- VAT no longer applies to crypto transfers after PMK50/2025 took effect on 1Aug2025.

- Exchanges must re‑publish a vetted whitelist by Apr2025 or face delisting.

Cryptocurrency is a digital asset that uses cryptographic techniques to secure transactions and control the creation of new units has always been a gray area in Indonesia. The country banned its use for payments yet allowed buying and selling as a commodity. That dual stance made compliance a maze for exchanges, fintech startups, and investors alike.

From Commodity to Digital Financial Asset: The Historical Context

When the first crypto‑exchange opened in Jakarta in 2018, the government classified every token as a commodity. The BAPPEBTI the Commodity Futures Trading Regulatory Agency issued a whitelist that grew to more than 850 assets by early 2025. Operators had to prove AML/KYC compliance, but capital requirements were modest-just enough to cover operational costs.

That model worked while the market was small, but rapid growth exposed gaps: consumer protection was weak, and the fragmented oversight made it hard for the central bank and the financial intelligence unit to monitor systemic risk.

The Legal Pivot: Law No.4/2023 and Government Regulation49

The turning point arrived with Law No.4 of 2023 the Development and Strengthening of the Financial Sector Law. The law gave the Financial Services Authority (OJK) the mandate to oversee “digital financial assets.” On 12Jan2023 the law was signed, and the transition was formally recorded in Government Regulation49 which transferred regulatory authority from BAPPEBTI to OJK.

Effective 10Jan2025, OJK became the single supervisory body for crypto trading, staking, and custody services. The re‑classification means crypto is now treated as a “digital financial asset” rather than a pure commodity, even though the underlying asset class remains unchanged for tax purposes.

OJK’s New Framework: What Exchanges and Traders Must Do

OJK rolled out Regulation No.27/2024 which details the implementation of digital financial asset trading on 10Dec2024. The key obligations are:

- Licensing: Every crypto‑trading platform must obtain an OJK licence before offering services.

- Capital standards: Minimum paid‑up capital of IDR100bn and equity of IDR50bn. OJK can demand more if the platform’s systemic impact is high.

- AML/CFT compliance: Operators must adopt the same “know‑your‑customer” protocols as banks. Suspicious transactions are reported to the Financial Transaction Reports and Analysis Center (PPATK).

- Whitelist management: By Apr2025, platforms must publish a refreshed list of approved tokens. Any asset not re‑approved by Feb2025 must be delisted.

- Data protection: Consumer data must be stored locally and encrypted; cross‑border data transfers need OJK clearance.

Failure to meet these standards can trigger license revocation, hefty fines, or even criminal prosecution.

Taxation Overhaul: PMK50/2025 and the End of Crypto VAT

Until mid‑2025, crypto transfers were subject to value‑added tax (VAT) under PMK68/2022 (amended by PMK81/2024). The new PMK50/2025-effective 1Aug2025-removes VAT from crypto asset transfers and aligns income‑tax treatment with other financial instruments.

Key takeaways for taxpayers:

- Capital gains on crypto sales are now taxed as ordinary income at the individual’s marginal rate.

- Businesses that trade crypto as a core activity must file quarterly tax reports using the new forms introduced by PMK53/2025.

- VAT‑registered entities can no longer claim input VAT on crypto purchases because the transaction is tax‑exempt.

The shift simplifies accounting and gives investors clearer guidance on their tax liabilities.

Operational Reality: How the New Rules Affect the Market

For the average trader, the biggest change is the higher capital bar. Smaller startups that previously operated with a few billion rupiah in equity now need to partner with banks or venture capital firms to meet the IDR100bn threshold. Many local exchanges have announced joint ventures with traditional financial institutions to stay afloat.

On the compliance side, the AML framework under OJK is more granular than the old BAPPEBTI rules. Operators must run automated transaction monitoring that flags patterns exceeding IDR500million in a 24‑hour window. The monitoring system must be certified by an accredited third‑party auditor each year.

From a consumer perspective, the stricter licensing regime means you’ll see fewer, but more trustworthy, platforms. OJK publishes a publicly accessible list of licensed operators, and each platform’s AML policy is now part of the public record.

Market Impact and Future Outlook

In the first half of 2025, the total market cap of Indonesian‑listed crypto assets slipped by about 12% as smaller players exited. However, the remaining exchanges reported a 28% increase in average daily volume, suggesting that liquidity is consolidating into more regulated venues.

Looking forward, two trends are shaping the conversation:

- Stablecoin debate: Industry groups are lobbying OJK to recognize stablecoins as a payment method. If approved, it could unlock a whole new use‑case for DeFi services.

- Cross‑border integration: Indonesia’s Financial Services Authority is in talks with Singapore’s MAS to create a mutual recognition framework for crypto licences, potentially easing entry for foreign firms that meet the capital standards.

All signs point to a more mature, albeit stricter, crypto ecosystem. Investors who value regulatory certainty are likely to favor Indonesia over neighboring markets that still lack clear oversight.

Key Takeaways for Different Stakeholders

- Traders: Verify that your platform holds an OJK licence and that your KYC documents are up‑to‑date.

- Exchanges: Secure the required capital, publish the updated whitelist, and upgrade AML monitoring before the July2025 deadline.

- Investors: Re‑assess tax liabilities under PMK50/2025 and factor in the higher compliance costs when projecting returns.

- Policy makers: Monitor the impact of the new framework on market depth and consider a phased approach to stablecoin legalization.

Frequently Asked Questions

Is cryptocurrency legal to own in Indonesia?

Yes. You can own, buy, sell, and hold crypto as a digital financial asset, but you cannot use it to pay for goods or services.

Do I need a special licence to run a crypto exchange?

All exchanges must obtain an OJK licence under Regulation No.27/2024. The licence requires a minimum paid‑up capital of IDR100bn and compliance with AML, data‑protection, and whitelist rules.

How are crypto gains taxed after the July 2025 reforms?

Gains are treated as ordinary income and subject to the individual’s marginal income‑tax rate. VAT no longer applies to crypto transfers under PMK50/2025.

What happens if an exchange lists an unapproved token?

OJK can order immediate delisting, impose fines, or revoke the platform’s licence. The whitelist must be refreshed by April2025, and any asset not re‑approved by February2025 is automatically prohibited.

Can foreign investors participate in Indonesia’s crypto market?

Yes, but they must partner with a locally licensed entity or set up a wholly‑owned subsidiary that meets the capital and AML requirements imposed by OJK.

Understanding the new regulatory environment helps you avoid costly missteps and take advantage of the clearer, more protected market that Indonesia is building for digital assets.

Comments

24 Comments

Peter Johansson

Hey folks, diving into Indonesia’s latest crypto overhaul feels like stepping into a new philosophy class – every rule reshapes the mindset of traders and investors alike 😊. The shift from commodity to digital financial asset isn’t just a label change; it’s a call for deeper reflection on how we value decentralized tech in a regulated world. Think of it as a meditation on risk and opportunity, where each compliance step becomes a breath in the ongoing practice of responsible investing.

Kyle Hidding

This regulatory overhaul is nothing but an exercise in bureaucratic overengineering. The capital requirement of IDR100bn is a staggering barrier to entry, effectively weaponizing financial thresholds to consolidate power among incumbent players. Moreover, the AML/KYC mandates are riddled with redundant data collection protocols that inflate operational costs without proportionate risk mitigation. In short, this is regulatory capture masquerading as consumer protection.

Andrea Tan

Sounds intense. I get why they want tighter controls, but smaller innovators might feel squeezed out. Hopefully the ecosystem finds a balance where compliance doesn’t stifle creativity.

Gaurav Gautam

Alright, let’s break this down. The OJK’s new framework is a massive move toward legitimizing crypto, and that’s a good sign for mainstream adoption. The capital bar, while steep, pushes operators to professionalize and partner with established financial institutions, which could boost trust. On the flip side, it could also wipe out a lot of home‑grown startups that drove early innovation in Indonesia. The whitelist requirement by April 2025 adds another layer of scrutiny – only tokens that meet specific criteria will survive, potentially weeding out speculative projects. All in all, it’s a double‑edged sword, but the direction feels right for a maturing market.

Chris Hayes

While the intentions are commendable, the execution leaves a lot to be desired. Setting a minimum paid‑up capital of IDR100bn is unrealistic for many emerging platforms and could centralize power in a handful of big players. The regulatory clarity is welcome, yet the fast‑track timelines for compliance may cause rushed implementations and expose users to unforeseen risks.

victor white

One cannot help but notice the underlying agenda – the consolidation of oversight under OJK seems less about protecting investors and more about tightening the leash on a technology that threatens established financial hegemony. The whispers of a shadow consortium influencing these regulations are hard to ignore when you examine the timing and the stakeholders benefiting the most.

mark gray

That’s an interesting perspective. It does feel like the balance of power is shifting, but hopefully the new rules bring more transparency.

Fiona Chow

Wow, the capital requirement is absurdly high – they must think we’re all sitting on piles of cash. It’s as if they want to turn crypto into a club only the ultra‑wealthy can join. Good luck to the little guys trying to break in.

Rebecca Stowe

Let’s stay hopeful! New rules can also mean a safer environment for everyone.

Aditya Raj Gontia

Regulatory fatigue is real – all this jargon just adds more paperwork without real benefits.

Kailey Shelton

Honestly, it’s just more red tape.

Angela Yeager

For anyone looking for a quick checklist, here’s what you need to verify: an OJK licence, the updated whitelist (published by April 2025), capital compliance (IDR 100 bn paid‑up, IDR 50 bn equity), and AML/KYC procedures aligned with PPATK guidelines. Keeping these items in order will help you stay on the right side of the new framework.

vipin kumar

Behind the scenes, there are whispers that foreign regulators are lobbying for a mutual recognition pact, which could be a strategic move to dilute OJK’s control. If that pact goes through, we might see a wave of offshore platforms slipping through the cracks, undermining the very safeguards these rules aim to create.

Lara Cocchetti

It’s clear that some elite groups are orchestrating these reforms to keep the crypto space under their thumb. The narrative of ‘protecting investors’ is just a smokescreen for consolidating power.

Mark Briggs

Sure, sure, another ‘consumer protection’ spiel.

mannu kumar rajpoot

Honestly, the whole thing feels like a coordinated effort to keep us in the dark. By imposing massive capital thresholds and a centralized whitelist, OJK is effectively deciding who gets to play in the crypto arena. That kind of gatekeeping isn’t just regulatory – it’s a power move that could silence innovative startups that don’t fit the traditional finance mold.

Tilly Fluf

While the concerns are valid, a structured framework could also foster investor confidence and attract institutional capital.

Darren R.

Wow!!! This is absolutely monumental!!! The sheer audacity of the Indonesian regulators to overhaul the entire crypto landscape in such a short span is mind‑boggling!!! It’s a strategic masterstroke, positioning Indonesia as a beacon of regulatory clarity in a sea of ambiguity. However, let’s not kid ourselves – the capital requirement is a massive gatekeeper, effectively filtering out the naïve and rewarding only the well‑financed elite. The OJK’s decisive move to centralize oversight should, in theory, reduce systemic risk, but it also concentrates power in a single institution, which could be a double‑edged sword. The whitelist requirement by April 2025 introduces a new layer of compliance that will force exchanges to rigorously vet tokens, potentially weeding out speculative junk, but also possibly stifling innovative projects that lack mainstream recognition. Tax reforms, particularly the removal of VAT, simplify the fiscal landscape, yet the reclassification of crypto gains as ordinary income will raise tax burdens for many. All in all, this is a bold, decisive, and potentially transformative shift that could either catapult Indonesia into a leading position in the global crypto arena or create an oligarchic choke point that hinders grassroots innovation!!!

Hardik Kanzariya

Great breakdown! I’d add that the community should proactively engage with OJK during the licensing process to ensure that the rules are applied fairly and transparently.

Millsaps Delaine

Let me take you on a winding journey through the labyrinth of Indonesia’s recent crypto metamorphosis, a saga that unfolds like a dense philosophical treatise on governance, economics, and the very nature of digital value. At its core, the shift from treating cryptocurrencies as mere commodities to recognizing them as “digital financial assets” reflects a profound ontological reclassification - we are no longer dealing with abstract speculative tools but with entities that possess intrinsic financial characteristics akin to securities. This pivot was precipitated by Law No. 4 of 2023, which, in the grand tapestry of legal reform, effectively transferred the custodial mantle from the BAPPEBTI to the OJK, thereby centralizing regulatory authority under a body traditionally tasked with overseeing banks and insurance firms. The ramifications of this handover are manifold. Firstly, the OJK’s oversight brings with it a robust framework of capital adequacy, mandating a staggering IDR 100 billion paid‑up capital and IDR 50 billion equity - a figure that not only uplifts the barrier to entry but also imposes a profound stratification upon market participants, separating the capital‑rich incumbents from the fledgling innovators. Secondly, the introduction of Regulation No. 27/2024 embeds a comprehensive suite of AML/KYC imperatives, aligning crypto platforms with the same rigors as traditional financial institutions, thereby reducing regulatory arbitrage and enhancing systemic resilience. Yet, the force of these reforms is not without its paradoxes. The removal of VAT via PMK 50/2025 simplifies the tax landscape and ostensibly reduces transactional friction, but the recharacterization of crypto gains as ordinary income re‑introduces a pervasive tax burden, potentially disincentivizing speculative activity while rewarding long‑term investment. Moreover, the obligatory whitelist renewal by April 2025 imposes an additional litmus test for token legitimacy, fostering a curated ecosystem that could, on one hand, prune malicious or low‑quality assets, but on the other, stifle experimental projects that lack immediate mainstream appeal. The market response has already manifested in a 12 percent dip in total market cap, paired with a 28 percent surge in daily trading volume on regulated exchanges - a clear indication that liquidity is consolidating rather than evaporating. Looking ahead, the discourse surrounding stablecoins presents a crucible of regulatory tension; should OJK grant them payment status, the ripple effects could democratize DeFi services and accelerate financial inclusion. Parallelly, the cross‑border dialogue with Singapore’s MAS introduces a tantalizing prospect of mutual recognition, potentially unlocking a trans‑national corridor for compliant crypto operations. In sum, Indonesia’s regulatory overhaul is both a clarion call for maturity and a crucible of challenge, demanding that stakeholders navigate a tightly regulated yet increasingly credible market landscape. The future, if steered wisely, could see Indonesia emerge as a paragon of balanced crypto governance, marrying innovation with protection in a seamless, globally resonant framework.

Jack Fans

Wow great analysis! Just a heads up, the OJK actually provides a public list of all licensed exchanges on their website – I’ve bookmarked it for quick reference. Also, remember the new AML monitoring software needs annual certification, so keep an eye on renewal dates.

kishan kumar

Interesting points – the formal tone of the regulations really pushes the industry toward professionalization 😊.

Vaishnavi Singh

The philosophical underpinnings of redefining digital assets merit deeper contemplation.

Linda Welch

Only the US gets to set the standard, obviously.

Write a comment