What's Happening with Crypto in Brazil?

Ever wonder why Brazil's cryptocurrency market is changing so fast? The Central Bank of Brazil is the primary regulatory authority for cryptocurrency operations in Brazil following the Brazilian Virtual Assets Law (BVAL) enacted in 2023. This law, which became effective in June 2023, is reshaping how crypto works in the country. Let's break down what this means for you.

Brazil's Crypto Regulation Breakdown

The Brazilian Virtual Assets Law (BVAL), Federal Law No. 14.478/2022, is the foundation of the country's crypto rules. BVAL became effective in June 2023, making Brazil one of the first major Latin American economies to implement comprehensive cryptocurrency regulation. This law designates the Central Bank of Brazil as the main regulator for Virtual Asset Service Providers (VASPs).

Before BVAL, crypto operations were in a gray area. Now, all crypto exchanges and service providers must register with the Central Bank. They also need to follow strict Anti-Money Laundering (AML) and Know Your Customer (KYC) protocols. This means verifying users' identities and monitoring transactions to prevent illegal activities.

Key Restrictions You Should Know

Stablecoins make up about 90% of Brazil's crypto transaction volume. Yet, the Central Bank has imposed strict rules on them. As of 2025, these rules include mandatory registration, transaction reporting, and compliance with foreign exchange regulations.

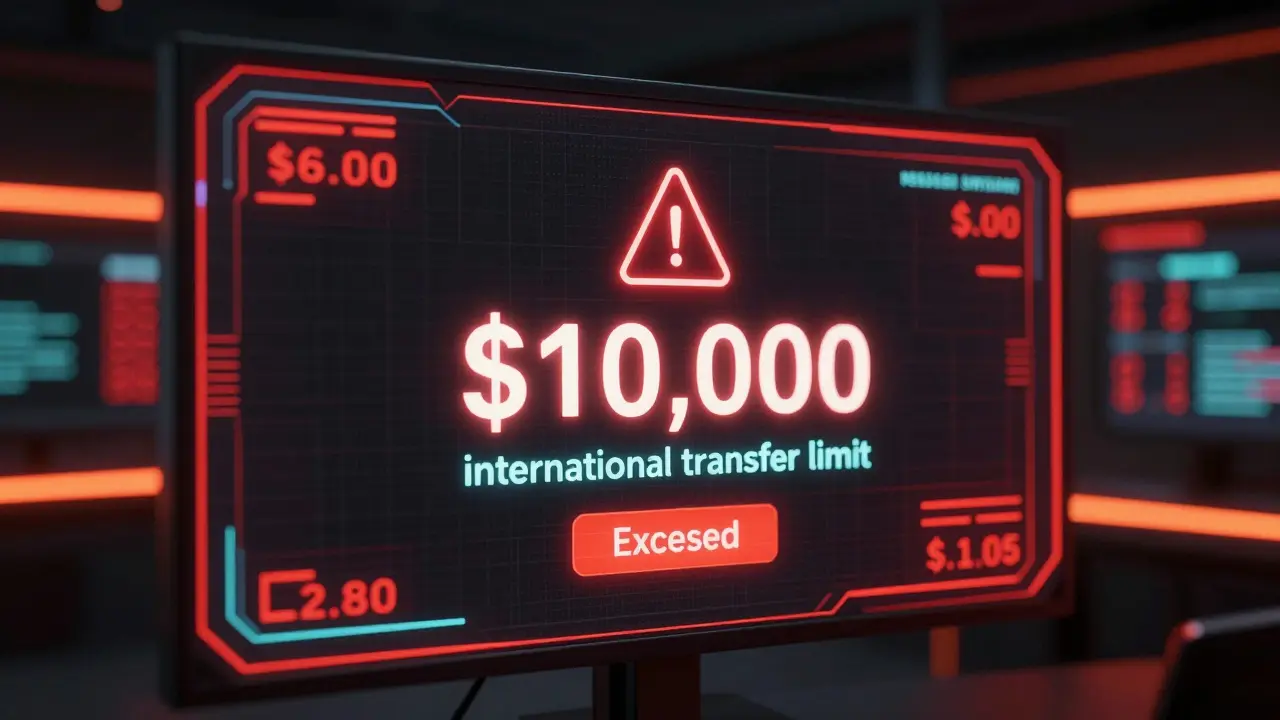

Another major restriction is the $10,000 cap on international transfers. This rule, introduced in 2025, affects how crypto exchanges handle foreign currency transactions. For example, if you want to send money abroad using crypto, you can't exceed $10,000 per transaction. This has forced many exchanges to focus on Brazilian real (BRL) transactions instead of international ones.

The Declaration of Crypto Assets (DeCripto), introduced in March 2025, requires detailed transaction reporting for all cryptocurrency activities. Exchanges must now integrate specialized compliance modules into their platforms. This means every trade, transfer, or wallet activity gets logged and reported to authorities.

How Exchanges Are Adapting

Crypto exchanges in Brazil are making big changes to stay compliant. Platforms like Mercado Bitcoin and Foxbit are investing heavily in advanced AML tools and real-time transaction monitoring systems. They're also launching user education programs to explain the new rules clearly.

Many exchanges are shifting to domestic-focused services. Instead of handling international transfers, they're prioritizing BRL transactions. This avoids the $10,000 cap issue and keeps operations within Brazil's financial system. Some platforms even offer educational resources to help users understand how these rules affect their crypto holdings.

Other Government Bodies Involved

The Central Bank of Brazil isn't working alone. The Securities and Exchange Commission of Brazil (CVM) handles cryptoassets that qualify as securities. They're expected to launch a public consultation on tokenization frameworks by September 2025.

The Financial Activities Control Council (COAF) serves as Brazil's financial intelligence unit. All VASPs must report suspicious transactions to COAF for analysis. This helps catch money laundering or illegal funding activities.

The Brazilian Revenue Service (RFB) enforces capital gains taxation on cryptocurrency profits. They require detailed reporting of all crypto transactions for tax purposes through annual declarations. This means you'll need to track your crypto trades for tax season.

What's Next for Crypto in Brazil

The Central Bank is developing the DREX platform, which is not a Central Bank Digital Currency (CBDC) but a distributed-ledger infrastructure for tokenized bank deposits and government securities. Current pilots involve major financial institutions and focus on domestic use only.

Regulators are also working on specific rules for stablecoins. Formal consultation processes are expected to produce detailed guidelines by late 2025. Industry analysts predict Brazil's approach will serve as a model for other emerging markets, balancing innovation with financial stability.

Frequently Asked Questions

What is the Brazilian Virtual Assets Law (BVAL)?

BVAL is Federal Law No. 14.478/2022, enacted in June 2023. It designates the Central Bank of Brazil as the primary regulator for cryptocurrency operations. The law requires all Virtual Asset Service Providers (VASPs) to register, implement AML/KYC protocols, and comply with transaction reporting rules.

Why are stablecoins restricted despite making up 90% of transactions?

The Central Bank views stablecoins as high-risk due to their role in facilitating cross-border transactions. Restrictions include mandatory registration, transaction monitoring, and compliance with foreign exchange rules. This aims to prevent money laundering and protect consumers from volatility, even though stablecoins dominate trading volume.

How does the $10,000 international transfer cap affect crypto users?

The cap applies to all international transfers, including crypto. If you send more than $10,000 abroad using crypto, exchanges must block the transaction. This forces users to either split transfers into smaller amounts or use alternative methods. Many exchanges now prioritize BRL transactions to avoid this issue entirely.

What is the DREX platform?

DREX is a distributed-ledger infrastructure for tokenized bank deposits, loans, and government securities. It's not a Central Bank Digital Currency (CBDC) but a tool for financial institutions to settle transactions faster and more securely. Current pilots involve major Brazilian banks and focus solely on domestic use.

Do I need to report crypto transactions for taxes?

Yes. The Brazilian Revenue Service (RFB) requires detailed reporting of all cryptocurrency profits and losses. You must include this in your annual tax declaration. Exchanges now provide transaction reports to help users comply, but it's your responsibility to file accurate reports.