The Investment and Securities Act 2025 didn’t just tweak old rules-it rewrote the playbook for crypto trading in the United States. Before this law, crypto markets operated in a legal gray zone. The SEC sued exchanges. The CFTC issued warnings. Companies didn’t know if their token was a security, a commodity, or something else entirely. That chaos is over. The 2025 Act, built around the CLARITY Act (Clarifying Law Around Investment Token Sales) and the GENIUS Act (Guiding and Establishing National Innovation for US Stablecoins Act), created clear categories, assigned jurisdiction, and gave the industry its first real federal rulebook.

Three Types of Crypto, One Rulebook

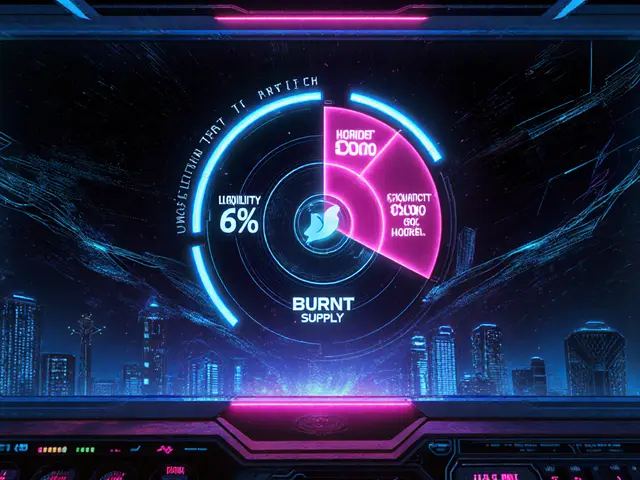

The heart of the 2025 law is a simple but powerful split: all digital assets now fall into one of three buckets. No more guessing. No more enforcement letters targeting the wrong thing.

- Digital commodities-like Bitcoin and Ethereum-are now officially under the Commodity Futures Trading Commission (CFTC). This means they’re treated like gold or crude oil. Trading them on a platform? That’s regulated like futures markets. No SEC approval needed.

- Investment contract assets-tokens sold with the expectation of profit from others’ work-are still under the Securities and Exchange Commission (SEC). But now, the SEC has to prove it under a clearer standard. They can’t just say, “This looks like a security.” They need to show how the token meets the legal definition of an investment contract.

- Permitted payment stablecoins-USD-backed tokens like USDC or USDT-are governed by the GENIUS Act. These must be issued by banks or federally licensed entities, hold 1:1 reserves in cash or short-term Treasuries, and undergo monthly audits. No more algorithmic stablecoins or unbacked tokens pretending to be stable.

This structure ended years of jurisdictional fights between the SEC and CFTC. Before 2025, the SEC claimed Bitcoin was a security. The CFTC said it was a commodity. Now, the law says: Bitcoin is a commodity. End of story.

What This Means for Crypto Exchanges

Before the Act, exchanges like Coinbase or Kraken faced constant legal threats. The SEC would sue them for listing tokens that might be securities. Now, the law protects platforms that list digital commodities. If you’re trading Bitcoin or Solana, you’re not violating securities law just because you’re also offering a token the SEC says is a security.

The Act also removes a major barrier: SEC-registered broker-dealers and trading platforms can now handle digital commodities without losing their exemptions. That’s huge. It means firms like Fidelity or Charles Schwab can legally offer Bitcoin trading under their existing licenses. No new registrations. No legal gray zones.

For crypto-native platforms, this means less fear of sudden enforcement. They can build products knowing the rules. No more scrambling every time the SEC drops a new lawsuit. And for users? It means more options. More institutions entering the market means better liquidity, tighter spreads, and more reliable trading.

Investment Firms and Compliance Got a Major Upgrade

Registered Investment Advisers (RIAs) used to live in fear. If an employee traded Bitcoin, was that a reportable security? Could they even hold it in client portfolios? The old rules didn’t say. Now, the CLARITY Act says: Bitcoin is a commodity. Commodity holdings don’t count as securities under SEC Rule 204A-1. That means RIAs no longer need to track every employee’s Bitcoin trade. No more pre-clearance forms for crypto. No more compliance headaches.

Even better: the law explicitly exempts digital commodities from state-level “blue sky” laws. That’s a big win for firms operating across multiple states. Before, they had to register in 50 different places. Now, one federal rule covers them all.

For crypto-focused funds, the Act opened the door to institutional custody. In September 2025, the SEC’s Division of Investment Management issued a no-action letter allowing registered advisers to hold crypto assets with qualified state trust companies. That’s the first time the SEC formally recognized state-chartered trust firms as safe custodians for digital assets. Before, only federally chartered banks were considered. Now, institutions like State Street Global Advisors can build crypto ETFs without worrying about custody risk.

Stablecoins Got a New Backbone

The GENIUS Act didn’t just regulate stablecoins-it forced them to grow up. Issuers must now be banks or federally licensed money transmitters. They must hold reserves in cash or U.S. Treasury bills. And they must publish monthly attestations from independent auditors.

This killed off the wild west of algorithmic stablecoins. TerraUSD? Gone. Any token that didn’t have real reserves? Disappeared from U.S. exchanges by the end of 2025. Now, only USDC, USDT (with full compliance), and a few new entrants like Circle’s new regulated product remain.

Why does this matter? Because stablecoins moved over $1.8 trillion in transactions every month in 2025. They’re the plumbing of crypto. If they’re unstable, the whole system crashes. The GENIUS Act made sure that plumbing is now built to last.

What’s Still Unclear?

Let’s be real-this law didn’t fix everything.

DeFi protocols? Still in a gray zone. The Act doesn’t mention decentralized exchanges or lending platforms. If you’re running a smart contract that lets users swap tokens without a middleman, you’re still technically operating in unregulated space. The SEC hasn’t said if they’ll come after you. They might. They might not.

Smaller crypto startups face higher compliance costs. Now that exchanges need to classify every token, they’re hiring lawyers and compliance teams. That’s expensive. Some indie projects can’t afford it. They’re either shutting down or moving offshore.

And while the SEC can’t block trading platforms for listing digital commodities, they can still sue issuers of tokens they believe are securities. That means the legal risk hasn’t vanished-it’s just shifted. The burden is now on token creators to prove they’re not selling securities, not on exchanges to guess.

How Traders Should Adapt

If you’re trading crypto in 2026, here’s what you need to do:

- Know your asset type. Is it Bitcoin? Commodity. Is it a token from a startup promising returns? Probably a security. Check the project’s documentation-many now label their tokens clearly.

- Use regulated platforms. Stick to exchanges that are SEC-registered or CFTC-compliant. They’ve done the work to stay legal. Avoid unregulated offshore sites.

- Watch for stablecoin audits. If you’re holding USDC or USDT, check their issuer’s monthly reserve reports. If they’re not publishing them, move your funds.

- Don’t assume DeFi is safe. Even if it’s popular, it’s not protected by the 2025 law. Use DeFi only with money you’re willing to lose.

For long-term investors, the law is a win. Regulatory clarity attracts institutions. Institutions mean deeper markets. Deeper markets mean less volatility over time.

What Comes Next?

The SEC is already working on new rules. Their Spring 2025 Regulatory Flex Agenda includes updates to custody rules, recordkeeping for blockchain-based trades, and how broker-dealers report crypto transactions. Expect more guidance by late 2026.

Some lawmakers are pushing for even more: a federal licensing system for crypto exchanges, mandatory KYC for all peer-to-peer trades, and rules for NFTs as investment vehicles. None of that is law yet. But the 2025 Act set the foundation. Future laws will build on it, not tear it down.

The U.S. is no longer the wild west of crypto. It’s becoming the most regulated-and possibly the most stable-market in the world. That’s good for investors. It’s good for innovation. And it’s good for the future of digital finance.

Is Bitcoin now legal to trade in the U.S. under the 2025 law?

Yes. Bitcoin is officially classified as a digital commodity under the CLARITY Act of 2025, placing it under CFTC jurisdiction. This means it’s fully legal to trade, custody, and invest in Bitcoin through regulated platforms like SEC-registered broker-dealers and CFTC-compliant exchanges.

Can I still use decentralized exchanges (DEXs) like Uniswap?

You can still use DEXs, but they’re not protected by the 2025 law. The Act only applies to regulated entities like exchanges and broker-dealers. Using a DEX means you’re operating outside the new regulatory framework, with no legal protections or oversight. You assume all risk.

Are all stablecoins now regulated?

Only USD-backed stablecoins issued by federally licensed banks or money transmitters are regulated under the GENIUS Act. Algorithmic stablecoins (like the collapsed TerraUSD) and non-USD stablecoins are not permitted on U.S. exchanges. All regulated stablecoins must maintain 1:1 reserves and publish monthly audits.

Does this law affect my personal crypto holdings?

No, not directly. The law regulates exchanges, issuers, and financial institutions-not individual traders. You can still hold any crypto you want in your wallet. But if you trade through a U.S.-based platform, they’re now required to classify assets correctly, which may affect what’s available to you.

Will this law make crypto prices more stable?

It’s likely to reduce volatility over time. By bringing institutional investors into regulated markets, increasing liquidity, and eliminating unstable stablecoins, the law creates a more reliable foundation. Short-term price swings will still happen, but the risk of market-wide crashes from unregulated tokens is now much lower.

Traders who adapted early saw lower fees, better execution, and access to new products like crypto ETFs from traditional firms. Those who waited are now playing catch-up. The era of regulatory uncertainty is over. The next phase is about execution-and who’s ready to build on it.

Comments

13 Comments

Melissa Contreras López

Finally! I’ve been waiting for this clarity like it was the last slice of pizza at a party. Bitcoin as a commodity? Yes please. No more SEC throwing tantrums every time someone buys ETH. I can actually sleep at night now knowing my portfolio isn’t one lawsuit away from vaporizing. 🙌

Mike Stay

It is with considerable gravitas that I acknowledge the legislative architecture embodied within the Investment and Securities Act of 2025, which, through the synergistic integration of the CLARITY Act and the GENIUS Act, has effectively dismantled the previously chaotic regulatory multiplicity that plagued digital asset markets in the United States. The delineation of asset classes into discrete, legally cognizable categories represents not merely a procedural refinement, but a foundational reorientation of American financial jurisprudence toward stability, transparency, and institutional confidence. This is, without hyperbole, a watershed moment.

Taylor Mills

lol the SEC still thinks they’re in charge. they’re just mad they can’t sue people anymore. crypto’s not ‘commodities’-it’s money now. and if you think big banks get to control stablecoins now, you’re sleepin’. they’re just putting lipstick on a pig. wait till the next crash and see who’s really holding the bag.

Arielle Hernandez

The structural clarity introduced by the 2025 Act is indeed a monumental advancement in U.S. financial regulation. The explicit jurisdictional assignment to the CFTC for digital commodities, coupled with the stringent reserve and audit requirements under the GENIUS Act, eliminates systemic ambiguity that previously discouraged institutional participation. Notably, the exemption of digital commodities from state-level blue sky laws represents a significant reduction in compliance burden for multi-state Registered Investment Advisers. Furthermore, the SEC’s no-action letter permitting state-chartered trust companies as qualified custodians marks a critical evolution in custody infrastructure-enabling the launch of physically-backed crypto ETFs without federal banking dependencies. This is not merely regulation-it is institutionalization.

HARSHA NAVALKAR

i dont understand why everyone is so happy. this law is just another way for america to control everything. why do we need banks to issue stablecoins? what if they freeze my money? what if they say i’m not allowed to trade? this feels like a trap. i miss the wild west.

Julene Soria Marqués

ok but like… who even reads these long ass articles? i just wanna know if i can still use uniswap without getting raided by the feds. also why do i care if my stablecoin has monthly audits? i just want my usdc to not drop to 50 cents. also… is this law gonna make my crypto taxes easier? because if not, i’m not impressed.

Bonnie Sands

they’re lying. this whole thing is a front. the fed is just making crypto look legit so they can track every single transaction. you think they care about ‘stability’? nah. they want to kill anonymity. soon they’ll make wallets illegal unless you give them your SSN, your blood type, and your zodiac sign. mark my words. this is the first step to crypto being outlawed entirely.

MOHAN KUMAR

good law. now exchanges stop lying. before, they listed 1000 coins and said ‘it’s not a security’-now they have to prove it. smart. but what about small devs? they can’t afford lawyers. this law helps big players, not the little guys.

Jennifer Duke

Oh, how quaint. The U.S. finally gets its act together while the rest of the world still thinks crypto is a playground. Honestly, it’s about time. We’ve been the only developed nation letting this chaos fester. Now that we’ve got the rules right, the rest of the world will have to follow our lead-or get left behind. And yes, I do mean literally. The dollar is still king, and now crypto is too.

Abdulahi Oluwasegun Fagbayi

the law gives form to chaos. but form is not truth. who decides what is a commodity? who holds the power to say what is ‘backed’? the system still chooses. the people still trust. and the trust is still fragile. this is not freedom. it is regulation dressed as safety.

Jeffrey Dufoe

so… can i now trade btc on schwab? yes? sweet. i’ve been waiting for this. no more weird apps. just my regular brokerage. finally feels like crypto’s part of the real world.

Adam Fularz

lmao they called it ‘clarity’ but it’s just more paperwork. now every startup needs a team of 10 lawyers just to say ‘this is not a security’. meanwhile, the people who actually built this stuff? they’re all gone. moved to switzerland or dubai. this law didn’t save crypto. it killed the dream.

Athena Mantle

so… the fed controls stablecoins now 😭 but at least my usdc won’t crash? 🤔 i mean… i guess that’s good? 🤷♀️ but why do i feel like i’m handing over my keys to the bank? 🏦✨ also… does this mean i can finally buy a crypto ETF without my dad yelling at me? 😘

Write a comment