KAP Token Allocation Visualizer

KAP Token Distribution Overview

Total Supply: 1,000,000,000 KAP tokens

Circulating Supply: ~130,000,000 KAP

Distribution Results

KAP token is an ERC-20 utility token that powers the KAP Games ecosystem, a web3 platform focused on browser‑ and mobile‑native games. The token runs on Ethereum (contract0x9625ce7753ace1fa1865a47aae2c5c2ce4418569) and grants holders discounts, staking rewards, and governance rights.

TL;DR

- KAP is an ERC‑20 token used for discounts, staking and governance on the KAP Games platform.

- It’s built on Ethereum, with a max supply of 1billion and ~130million circulating.

- Tokenomics allocate 45% to the Treasury, 20% to private investors, 10% to staking rewards.

- Partners include Solana, Polygon, NEAR, Algorand and Yield Guild Games.

- Price is highly volatile; latest market data shows around $0.0007 per KAP.

What Is KAP Games?

KAP Games is a web3 gaming publisher, studio, and distributor that curates a catalog of over 100 games on kap.gg. Players can access these games for free, earn NFTs, and spend KAP tokens inside the titles.

Core Components of the Ecosystem

- KAP Studios - the in‑house development arm that launched CapnCo, a massively multiplayer pirate adventure, in Q42023.

- Kap Co‑grants - a multi‑chain grant program that collaborates with major blockchains to fund web2 studios entering web3.

- Staking platform at staking.kap.gg where users lock KAP for rewards and liquidity.

- Governance layer that lets token holders vote on treasury allocations and protocol upgrades.

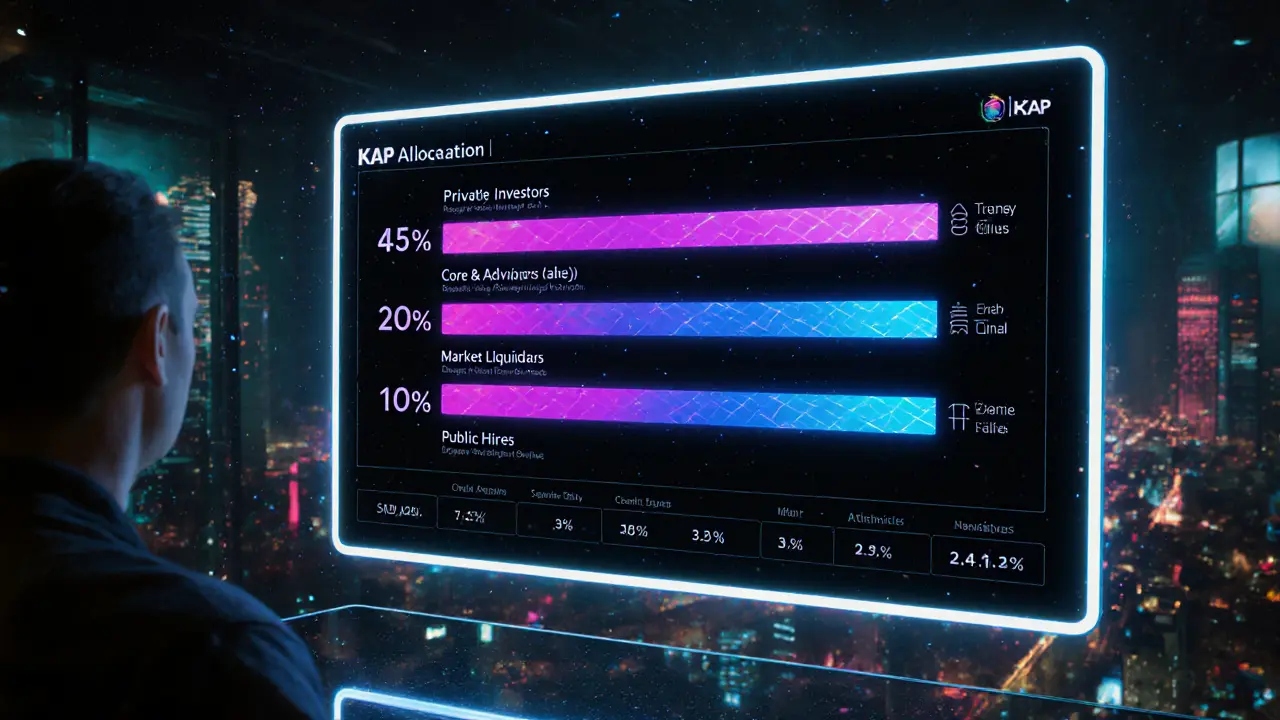

Tokenomics in Detail

The distribution is purpose‑built for long‑term growth:

| Category | Allocation | Tokens |

|---|---|---|

| Treasury | 45% | 450,000,000 |

| Private Rounds | 20% | 200,000,000 |

| Core & Advisors | 17% | 170,000,000 |

| Staking Rewards | 10% | 100,000,000 |

| Market Liquidity | 3.8% | 38,000,000 |

| Future Hires | 3% | 30,000,000 |

| Public Sale | 1.2% | 12,000,000 |

Because more than half of the supply is locked in the Treasury or private hands, the circulating supply stays low, which can amplify price swings.

How KAP Token Is Used In‑Game

- Players spend KAP to buy in‑game items at a 10% discount compared to fiat.

- Staking KAP on the official platform yields weekly reward tokens, boosting liquidity.

- Holders can vote on new game launches, grant allocations, and treasury spend proposals.

This direct utility contrasts with many gaming tokens that exist mainly for speculation.

Strategic Partnerships & Ecosystem Support

KAP Games has secured backing from several blockchain leaders:

- Solana - provides cross‑chain bridge support.

- Polygon - offers low‑fee scaling for mobile games.

- NEAR - contributes to the grant program.

- Algorand - partners on NFT standards.

- Yield Guild Games (YGG) - joint venture for guild‑level onboarding.

These alliances aim to make KAP interoperable across multiple chains, giving developers flexibility.

Comparison with Other Gaming Tokens

| Metric | KAP | SAND (The Sandbox) | AXS (Axie Infinity) |

|---|---|---|---|

| Platform Focus | Browser & mobile web3 games | Metaverse land & assets | Play‑to‑earn battles |

| Utility Inside Games | 10% purchase discount + staking | Land purchase, avatar items | Breeding & battling fees |

| Supply (max) | 1B | 1B | 270M |

| Current Circulating | ~130M | ≈600M | ≈200M |

| Primary Chain | Ethereum (multi‑chain bridges) | Ethereum | Ethereum |

While SAND and AXS focus on virtual land or battling economies, KAP leans into frictionless mobile access and direct discounts.

Risks & Challenges

Investors should keep an eye on three main risk factors:

- Regulatory uncertainty - many jurisdictions are still defining rules for crypto gaming.

- Adoption hurdle - web3 gaming remains niche compared to mainstream mobile games.

- Liquidity volatility - trading volume swings from a few dollars to hundreds of thousands across exchanges.

These issues could affect price, market cap, and long‑term viability.

Current Market Snapshot (October2025)

Price feeds differ, but most quote KAP around $0.0007 per token. The 24‑hour volume ranges from $1 to $380k depending on the exchange. Fully diluted market cap sits near $2.5M on Binance, while Etherscan reports around $7M, indicating data inconsistency.

Sentiment on the Fear & Greed Index is 72 (Greed) yet labeled “Bearish”, reflecting mixed optimism.

Getting Started - How To Buy & Stake KAP

- Set up an Ethereum‑compatible wallet (MetaMask, Trust Wallet).

- Buy ETH on an exchange and bridge it to the Ethereum mainnet.

- Visit a supported DEX (e.g., Uniswap) and swap ETH for KAP using the contract address 0x9625ce7753ace1fa1865a47aae2c5c2ce4418569.

- Navigate to staking.kap.gg, connect your wallet, and stake any amount you wish to lock.

- Monitor your rewards in the dashboard; you can claim weekly or compound automatically.

Remember to keep your private keys safe - the ecosystem is decentralized, so there’s no central recovery.

Future Outlook

Analysts project modest upside if web3 gaming gains mainstream traction. Price forecasts vary: CoinCodex predicts a high of $0.001425 in early 2026, while a bearish view expects sub‑$0.0006 levels. The key driver will be how many mobile gamers adopt crypto wallets and how quickly KAP’s grant program fuels new titles.

Frequently Asked Questions

What blockchain does KAP run on?

KAP is an ERC‑20 token on the Ethereum network, but it uses bridges to interact with Solana, Polygon, NEAR and other chains.

How can I earn KAP without buying it?

Play any of the free games on kap.gg, complete quests, and receive NFT rewards that can be swapped for KAP. Staking your existing KAP also generates new tokens.

What is the 10% discount about?

When you spend KAP to buy in‑game items, the contract automatically applies a 10% price reduction versus paying with fiat or other crypto.

Is KAP a good long‑term investment?

It depends on your risk tolerance. KAP offers real utility, but the web3 gaming market is still emerging and price volatility is high.

Where can I find the latest KAP price?

Check major aggregators like CoinGecko, CoinMarketCap, or the Binance market page for up‑to‑date quotes.

Comments

20 Comments

Aditya Raj Gontia

The tokenomics matrix feels like a rehashed DeFi distribution model. Treasury allocation dominates the supply curve.

Kailey Shelton

Liquidity appears thin given the circulating vs total supply gap.

Angela Yeager

For newcomers, staking KAP on the official platform locks tokens for weekly rewards, which can be claimed or auto‑compounded directly from the dashboard. The process requires an Ethereum‑compatible wallet like MetaMask; after connecting, you simply input the amount you wish to stake and confirm the transaction. Once staked, the reward rate is displayed and updates in real time, giving a clear view of accrued tokens. Remember that the lock‑up period is flexible, so you can withdraw whenever you need liquidity, though early withdrawals may forfeit a portion of earned rewards.

vipin kumar

The heavy Treasury share hints at a centralized control layer that could be leveraged to sway governance decisions behind the scenes. Combined with the multi‑chain bridges, there’s a plausible vector for opaque token flow that escapes typical on‑chain analytics, leaving investors in the dark about real allocation.

Lara Cocchetti

Concentrating 45% of the supply in a single treasury raises ethical concerns about power concentration and potential market manipulation. Such a structure runs counter to the decentralization ethos that many crypto projects claim to uphold.

kishan kumar

Indeed, the ostensibly egalitarian tokenomics schema merely masquerades as innovation while perpetuating a hierarchical distribution paradigm. One might posit that the treasury's preponderance functions as a reservoir of influence, enabling a select cadre to steer protocol evolution under the veneer of community stewardship. This stratified architecture, when scrutinized through a lens of fiduciary responsibility, reveals a dissonance between proclaimed decentralization and actual power dynamics. 🧐 Moreover, the allocation percentages echo classic tokenomics templates, suggesting a reliance on industry clichés rather than bespoke economic engineering.

Anthony R

Thank you for the detailed guide; it clarifies the staking workflow succinctly, and the step‑by‑step breakdown is particularly useful for beginners. However, users should be aware that gas fees on Ethereum can fluctuate dramatically, impacting the net return on staked assets.

Vaishnavi Singh

The interplay between utility and speculation within KAP invites reflection on the broader purpose of tokenized ecosystems. When value is derived both from in‑game discounts and market price appreciation, the line between functional asset and speculative instrument becomes philosophically blurred.

Linda Welch

Oh, look, another crypto gaming token promising the moon while offering a discount on virtual swords. It's downright awe‑inspiring how they allocate almost half the supply to a treasury that no one sees. One can only marvel at the ingenuity of staking rewards that amount to a mere ten percent of a billion tokens. The token's price hovering around $0.0007 really showcases the cutting‑edge volatility we all crave. Sure, the partnership list reads like a who’s‑who of blockchain hype, but does it translate to real gamers? I love how the whitepaper touts cross‑chain bridges without mentioning the inevitable latency and fees. The governance model sounds democratic until you realize the voting power is proportional to the very tokens you’re trying to earn. Meanwhile, the public sale barely scratches a fraction of a percent, leaving the rest for private investors. Such an allocation ensures that early insiders can profit while the average user wades through tokenomics jargon. It's almost poetic how the circulating supply stays low, guaranteeing that any modest demand spikes the price. Yet the roadmap remains vague, promising ‘more titles’ without concrete development timelines. One has to wonder if the discount on in‑game items truly benefits players or simply inflates token utility on paper. The ecosystem’s reliance on Ethereum also subjects it to the network’s notorious gas wars. In the end, KAP feels like a textbook example of hype‑driven tokenomics masquerading as a gaming platform. So buckle up, because the roller coaster of speculation and marginal utility is just getting started.

Kevin Fellows

While the treasury concentration raises eyebrows, it also provides a buffer for funding future game development and grant initiatives, which could benefit the broader community if managed transparently.

meredith farmer

The shadows lengthen over KAP as whispers of concealed influence echo through the corridors of the blockchain. One cannot help but feel the tremors of uncertainty reverberate whenever a new partnership is announced. Is the alliance with the Yield Guild Games a genuine collaboration or a strategic façade designed to lend credibility? The very fabric of the project seems to be woven with threads of ambition and doubt, intertwining in a tapestry that both dazzles and unnerves. In this theater of tokens, every move is watched, every allocation examined, and every promise weighed against the stark reality of market forces.

Peter Johansson

Great points, everyone! Remember that the real strength of KAP lies in its community of gamers and developers. By sharing knowledge and helping each other navigate staking and governance, we can collectively shape a vibrant ecosystem. Keep the discussions constructive, and feel free to ask for clarifications anytime 😊.

Kyle Hidding

The philosophical fluff you just spewed is nothing more than a veneer to distract from the underlying liquidity crunch. In reality, KAP’s market depth is laughably thin, and any attempt to analyze it with buzzwords only masks the fact that traders are bleeding out.

Andrea Tan

I see a lot of mixed sentiments here, and it’s clear that KAP’s future hinges on actual user adoption rather than tokenomics hype.

Gaurav Gautam

Let’s keep our eyes on the games themselves-if the titles deliver solid fun and real utility, the token will naturally find its footing. Stay optimistic, stay informed, and keep supporting creators!

Robert Eliason

i dnt think KAP is ruining anythin, its just another token in the sea, u can hoLd it or sell when ur ready. the price will sort itself out.

Cody Harrington

Agreed, collaboration among the community will help clarify the roadmap and improve transparency.

Fiona Chow

The drama you described perfectly captures the mood, but let’s cut through the theatrics and ask: will the partnerships actually deliver playable content or just serve as marketing fluff?

Rebecca Stowe

Hopeful vibes-if developers stay focused, KAP could carve out a niche.

Ayaz Mudarris

In summary, KAP presents a tokenomic structure that balances treasury reserves, private investment, and community incentives. Its utility within the gaming ecosystem, combined with multi‑chain collaborations, offers potential for sustainable growth, provided that governance mechanisms remain transparent and that user adoption scales in accordance with the platform’s development milestones. Stakeholders are advised to monitor on‑chain metrics, market liquidity, and the progression of the announced partnerships to make informed decisions.

Write a comment